The 2019 NAHB International Builders Show is around the corner and NVISION is gearing up to be there!

S&P Global recently released its Building Materials Industry Top Trends 2019, highlighting some of the key trends, takeaways, and forecasts the building materials industry will be keeping its eye on this year, and especially at IBS 2019.

Based on the trends report, here are our three key takeaways that all building materials industry leaders should know!

Commodity Costs Will Continue to Grow

As the report points out, commodity costs for the building industry in North America rose in 2018 for several reasons, including decreasing unemployment, new tariffs, and increased demand. And S&P Global expects those same factors to continue to drive commodity prices up in 2019.

“So far, most building materials companies have been able to offset the cost increases with higher pricing, but it remains to be seen if companies can continue to maintain higher prices in 2019,” the report says. With S&P Global predicting a 3 percent increase in building materials costs in 2019, the building materials industry will need to look at cutting costs and optimizing their supply chains to offset this increase in prices and maintain their margins without continuing to raise prices.

Increased Prices Could Slow the Building Materials Recovery

As the report states, low inventory, higher home prices, and higher interest rates may be pushing marginally qualified homebuyers out of the North American market. This, S&P Global says, could bring a halt to the building materials recovery. “Existing home sales (a big driver of repair and remodel activity) could slow if values remain high and available inventory low,” the report claims. With fewer pre-existing homes being purchased, fewer old houses will be getting remodeled and repaired by new homeowners, and that means less business for building materials companies.

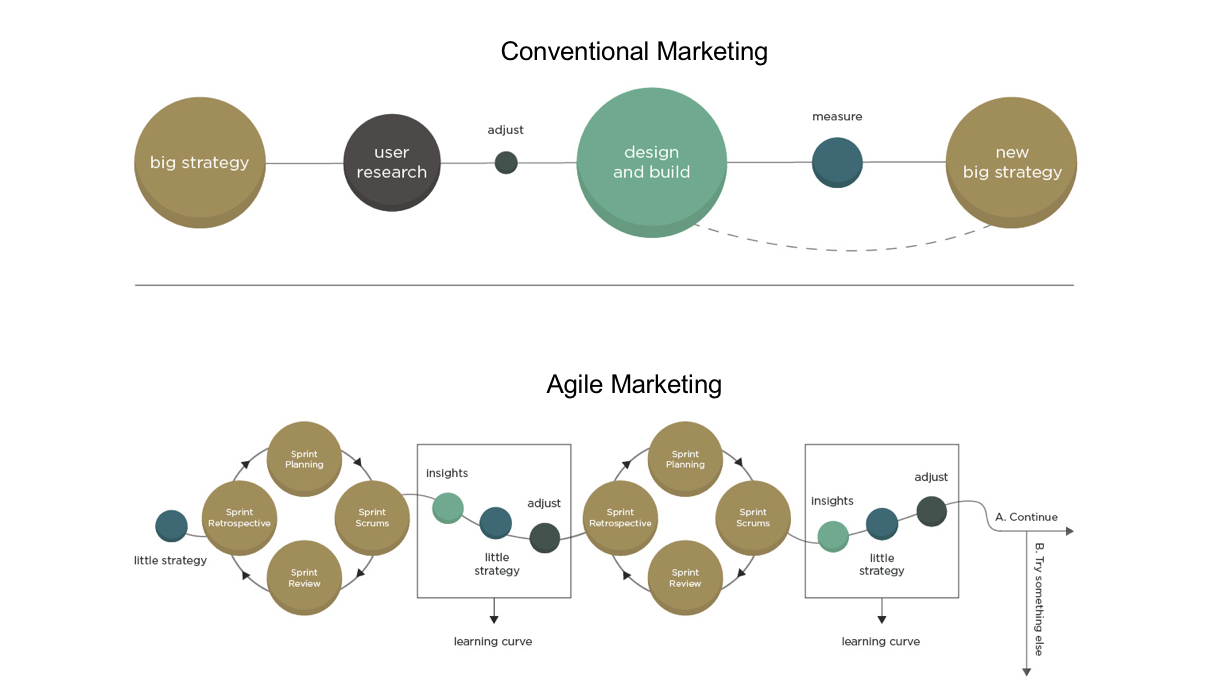

With building materials companies competing for homeowners with fewer dollars to spend – or with new construction townhomes that don’t need remodeling – they will need to find other ways to protect their margins, including finding ways to cut costs and compete on the customer experience with enhanced agility and responsiveness.

The Building Materials Market is Healthy, But with Growing Risk

When it comes to the numbers, the S&P Global report predicts modest growth in the North American building materials market. “We expect 2.3 percent real GDP growth, 3.6 percent unemployment, and 1.3 million housing starts. We further expect mid-single-digit growth in repair and remodeling activity, and only 2.8 percent growth in nonresidential construction,” the report states.

As a result, S&P Global is predicting another year of improved sales and earnings for building materials companies. But, the report says, “with much less growth than in 2016 and 2017.” What’s more, due to the affordability and availability issues of new homes mentioned above, S&P Global warns that housing starts could actually retreat slightly in 2019. To combat this problem, many builders will “attempt to address this by offering more value-based entry-level housing,” which will present an enormous opportunity to building materials companies who are able – thanks to a nimble, efficient supply chain – to offer reduced prices on materials and faster delivery timelines.

*****

The 2019 NAHB International Builders Show promises to be one to remember. With these trends in mind, building materials companies will want to be on the lookout for experienced partners who can help them cut costs and better optimize their supply chain management in order to capitalize on this shifting market.

NVISION will be there, and we hope to see you!

Related blogs:

Subscribe to the Blog

Why NVISION?

For more than three decades we’ve partnered with Fortune 500 companies to deliver marketing operations solutions. Led by a strategic account management team, we’ll help you develop, procure, fulfill and distribute printed collateral, signage, point-of-purchase displays, direct mail, branded merchandise and much more.

Project Title

Project Title Project Title

Project Title